Are you struggling to make ends meet? Do you feel like you’re constantly in a financial bind? If so, don’t worry – you’re not alone. Millions of people are dealing with the same thing right now looking for spotloan alternative and other options to get money. But that doesn’t mean that you have to accept your situation and just live with it. There are things that you can do to solve your financial problems. In this blog post, we will discuss smart strategies that will help you get your finances back on track!

If you’re struggling with financial problems, the first thing that you need to do is take a step back and assess your situation. What are your monthly expenses? How much money do you bring in each month? Once you have a clear picture of your finances, you can start to look for ways to cut costs and increase your income.

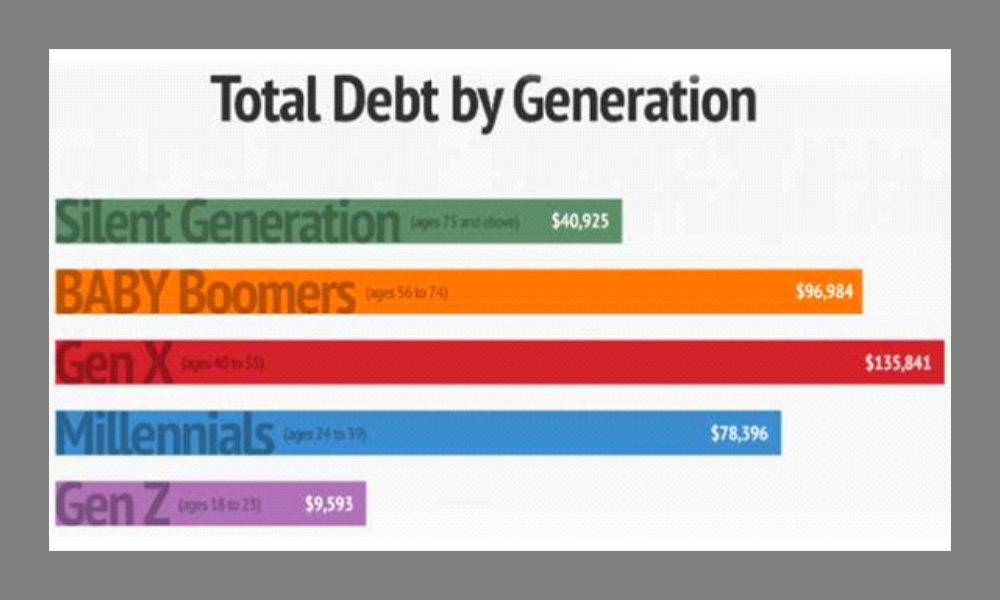

The Typical American’s Debt by Age

You’ve probably heard the saying “You have to spend money to make money.” Economists debate that, but there’s little doubt that people spend more when they’re making more. The average American has $90,460 in debt, according to a 2021 CNBC report. That included all types of consumer debt products, from credit cards to personal loans, mortgages, and student debt.

These statistics show that across all age groups, Americans are struggling with debt. However, it is important to remember that these are averages and that not everyone falls into the same category. There are many factors that can contribute to the amount of debt someone has, such as income level, job security, and medical expenses. If you find yourself struggling with debt, there are resources available to help you get back on track.

Take a Step Back And Assess Your Situation

The first step in solving your financial problems is to step back and assess your situation. What are your monthly expenses? How much income do you generate each month? Once you clearly understand your finances, you can begin identifying opportunities to cut costs and boost your income. At this juncture, the importance of professional guidance becomes clear. Seeking advice from financial advisors like Team Hewins can provide strategic insights and tailored recommendations that help navigate complex financial landscapes, ensuring that your decisions support your long-term financial goals.

Look For Ways To Cut Costs

Once you have a clear picture of your finances, you can start to look for ways to cut costs and increase your income. One way to cut costs is to take a close look at your monthly expenses and see where you can make adjustments. For example, if you’re spending $100 a month on streaming services, you may be able to cut that down to $50 by canceling one or two of them. Or, if you’re eating out multiple times a week, try cooking more meals at home.

Increase Your Income

If you’re struggling to make ends meet, one of the best things that you can do is increase your income. There are a number of ways that you can do this, such as getting a better-paying job, starting a side hustle, or investing in real estate.

Making even a small change in your income can have a big impact on your financial situation. If you’re not happy with your current job, look for opportunities to move up within your company or look for a new job altogether. If you don’t have much extra time, there are plenty of side hustles that you can do to bring in some extra cash. And if you’re willing to take on some risk, investing in real estate can be a great way to make money.

Use Cash Advance Apps

If you’re in a bind and need cash quickly, there are a number of apps that you can use to get a cash advance. These apps essentially allow you to borrow money against your next paycheck, so they should only be used as a last resort.

Use Credit Cards Wisely

If used correctly, credit cards can be a great tool to help you solve your financial problems. However, if used incorrectly, they can make your situation even worse. If you’re struggling with debt, it’s important to be strategic about how you use your credit cards.

For example, if you have a balance on a high-interest credit card, you may want to consider transferring the balance to a card with a lower interest rate. Or, if you’re trying to build your credit, you may want to use a credit card that offers rewards like cash back or points.

Create a Budget

Creating a budget is one of the best ways to solve your financial problems. When you create a budget, you’ll have a clear picture of your income and expenses, which will allow you to make changes as needed.

There are a number of different ways that you can create a budget, but one of the easiest is to use a spreadsheet or an online tool like Mint or You Need a Budget. Once you’ve created your budget, be sure to stick to it as closely as possible.

Set Up Automatic Payments

One way to avoid late fees and interest charges are to set up automatic payments for all of your bills. This way, you’ll never have to worry about forgetting to pay a bill on time.

You can usually set up automatic payments by logging into your online account for each company. Once you’re logged in, look for the option to set up automatic payments and follow the instructions.

Make a Plan

Once you’ve taken a close look at your finances and created a budget, it’s time to make a plan. This plan should include both short-term and long-term goals. For example, if you’re trying to get out of debt, one of your short-term goals may be to create a Debt snowball. This is where you focus all of your energy on paying off one debt at a time, starting with the debt with the lowest balance. As you pay off each debt, you’ll have more money to put towards the next debt on your list.

One of your long-term financial goals may be to save up for a down payment on a house. This is a big goal that will take time and effort to achieve, but it’s important to have a plan in place so that you can make progress towards it.

Solving your financial problems can seem like a daunting task, but it doesn’t have to be. By following these simple tips, you’ll be on your way to financial freedom in no time. Just remember to stay disciplined and focused on your goals, and you’ll be well on your way to success. Thanks for reading!

Also Read: 6 Tips for Keeping Your Small Business Financially Healthy