The environment in the mortgage industry is fast-paced and deadline-driven. As a result, mortgage professionals must efficiently manage their time to ensure projects are completed accurately and on time. This is why many mortgage businesses are incorporating timesheet applications to boost productivity.

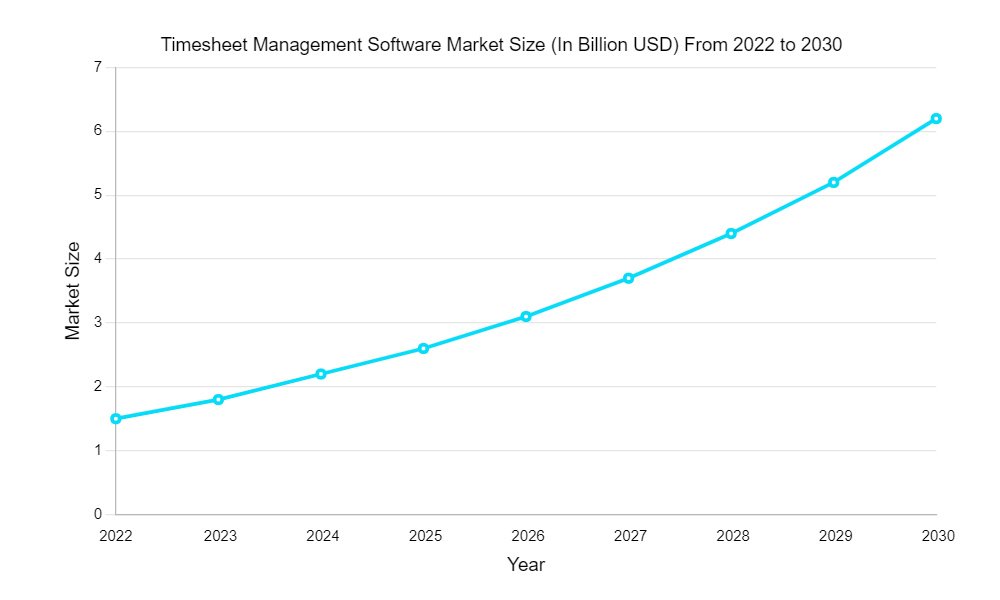

According to a report from Bezinga, the global market for timesheet management software is anticipated to expand at a CAGR of 9% between 2023 and 2030. This growth is proof of the rising demand for robust time-tracking tools that provide enhanced visibility and productivity across teams. However, for mortgage professionals, comprehensive timesheet applications have become indispensable business tools.

The Growing Need for Timesheet Apps in Mortgage

Timesheet apps allow for real-time tracking of the duration that mortgage loan officers, processors, and underwriters spend on client files. This detailed tracking ensures no billable hours are lost and the progress of every mortgage application is documented properly. In addition, it enables greater accountability among employees, leading to maximized productivity and streamlined operations.

With the global Timesheet Management Software market on a significant rise, it’s essential to delve deeper into the features that make these applications stand out. This leads us to the next section, which highlights the advanced functionalities of timesheet applications.

Key Features of Advanced Timesheet Applications

The advanced timesheet systems available today offer extensive features beyond basic time recording. They include:

1. Comprehensive Timesheet Management

Monitoring and analyzing the timesheets and recorded work hours of employees is quite tasking. However, with an advanced timesheet application, you get:

- Intuitive dashboard for easy timesheet creation, submission, approval routing, and status tracking.

- Customizable timesheet fields to capture relevant mortgage data like client name, loan type, application stage, etc.

- Calendar view for entering time within required date ranges based on mortgage deadlines.

- Ability to add comments or notes to timesheet entries when required.

- Seamless integration with billing systems for automated client invoicing.

- Multi-level approval workflows for timesheets to match company hierarchy.

- Email/alert notifications for pending timesheet approvals to prevent delays.

2. Granular Time Tracking

Timesheet applications make it much easier to assess the number of hours that employees spend on each task for a specified period. They offer:

- Flexible time entry in hours, minutes, or decimal minutes for accurate mortgage billing. With this, employees can easily punch in and out using a time punch clock or through web and mobile apps.

- Ability to track time against projects, tasks, clients, and custom fields.

- “Timer” feature to automatically record time spent on mortgage tasks.

- Easy time logging from anywhere via web and mobile apps.

- Capturing billable and non-billable time through clear status indicators.

3. Task and Project Management

Most businesses run several projects at the same time; therefore, they’re often looking for ways to manage each project without making mistakes. With a timesheet application, managers can:

- Create projects and sub-tasks as required.

- Assign tasks to specific employees based on specialization and workload.

- End-to-end tracking of time spent on each task and project.

- Manage task priorities and dependencies using Visual Kanban boards and Gantt charts

- Configurable workflows to map business processes within the timesheet system.

4. Custom Analytics and Reporting

Advanced time tracking makes timesheet management in small businesses more manageable through:

- Standard reports for timesheet audit, payroll, billing, and mortgage KPIs.

- Simple drag-and-drop report builder to create customized reports.

- Interactive dashboards with filters to analyze mortgage data from timesheets.

- Ability to export timesheet reports into CSV, Excel, and PDF formats.

- Scheduled report emailing to automatically send mortgage data to managers.

5. Access Control and Security

Timesheet applications ensure the security of companies’ data by providing the following:

- Role-based access control of timesheet data as per mortgage business hierarchy.

- Confidential access permissions can be set for different mortgage application stages.

- Audit trail capturing all modifications and access of timesheets.

- SOC 2 Type II and ISO 27001 compliance for data security.

- 256-bit SSL encryption of timesheet application data.

- Regular third-party audits and security testing.

Now that we’ve explored the diverse features of timesheet applications, one might wonder about the tangible benefits these features bring to the mortgage business. Let’s dive into the advantages that can be reaped by implementing these applications.

The Benefits of Implementing Timesheet Applications In Mortgage Business

Implementing an advanced timesheet management system for a mortgage business delivers multifaceted benefits such as:

1. Streamlined Project Monitoring

Real-time timesheet tracking gives managers first-hand information about the progress of each mortgage application. With such insights, mortgage businesses can avoid delays and inefficiencies, thus giving the business a boost.

2. Optimized Resource Planning

Analyzing timesheet data allows mortgage professionals to plan their time appropriately. In addition, it enables managers to make smart decisions on task assignments, deadlines, and employee workloads thus preventing redundancies.

3. Compliance and Audit-Readiness

One of the most important requirements for mortgage businesses is to keep clear records of all business activities. By having an advanced time-tracking system, mortgage businesses can keep meticulous records of project files, applications, employee work hours, attendance, etc., in compliance with the requirements stated in the Fair Labor Standards Act (FLSA),

4. Preventing Mortgage Team Burnout

Timesheet applications keep track of projects, clients, employees, work hours, etc. Therefore, it is easy for managers to distribute workloads more evenly and monitor employee hours, including overtime. This way, every employee only gets the workload that they can handle; thus preventing burnout.

The benefits of timesheet applications are undeniable. But how do real-world applications measure up? Let’s take a closer look at a specific case study, Beyond Intranet’s HR Timesheet 365, to understand its practical implications in the industry.

Case Study: Beyond Internet’s HR Timesheet 365

HR Timesheet 365 is an advanced time-tracking platform built specifically for mortgage businesses. Some of its key features include:

- Seamless Project Oversight – The platform allows managers to break down mortgage applications into tasks and track real-time progress through team timesheets. This enhances oversight and prevents delays.

- Custom Mortgage Reports – The software allows the generation of custom reports tailored to different mortgage roles like loan officers, underwriters, etc.

- Mortgage Task Management – The HR Timesheet 365 saves time by allowing mortgage businesses to manage all tasks, deadlines, and assignments within the timesheet system itself..

- Access Permission Controls – This timesheet app allows mortgage businesses to set up confidential access permissions as per their policy to protect sensitive mortgage application data.

By leveraging HR Timesheet 365, leading mortgage providers have increased productivity by over 20% within 3 months. The enhanced visibility into mortgage workflows has led to optimized planning and on-time application processing.

While the case study provides a detailed look at one application, many questions arise when businesses consider adopting such software. Addressing these concerns, let’s explore some of the most frequently asked questions about timesheet applications in the mortgage business.

Frequently Asked Questions

- How can timesheets help mortgage businesses?

Timesheets allow real-time tracking of time spent on client files and applications by mortgage teams. This leads to maximized productivity, accountability, and streamlined processes.

- What are the key features of timesheet apps?

Core features include intuitive timesheet submission, task management, and detailed reports. Alongside this, it also includes visual data insights, compliance controls, and integrations with tools like Power BI.

- What are the benefits of using timesheet software?

Key benefits for mortgage businesses include transparency in workflows, efficient resource allocation, timely project delivery, optimized team productivity, and data-driven decision-making.

- How much time does it take to implement a timesheet system?

Leading timesheet software can be smoothly implemented across teams within 2-4 weeks with proper change management and user training.

Bottom Line

As we wrap up our exploration of timesheet applications in the mortgage business, it’s evident that their significance is growing rapidly. With the market poised for expansion, businesses should consider leveraging these tools to enhance productivity and streamline operations.

As mortgage application volumes and complexity increase, comprehensive timesheet systems are becoming essential for mortgage businesses seeking enhanced productivity. By providing detailed visibility into workforce productivity, project progress, and process efficiency, advanced timesheet applications like HR Timesheet 365 empower mortgage providers to maximize output and streamline success.

Also Read: 10 Insightful Time Management Interview Questions and Answers