Gold (XAUUSD) stands out as a steadfast and dependable asset, boasting centuries of stability attributed to its unique properties such as rarity, durability, and versatility. In recent decades, the advent of electronic exchange trading has further democratized access to this precious metal for investors worldwide.

Traded in vast volumes across key global exchanges such as New York, London, and Tokyo, all gold transactions are primarily denominated in US dollars per troy ounce. The metal’s price is shaped by the dynamics of supply and demand in the market, with its prominence as a protective asset becoming increasingly evident. During market uncertainties, gold’s value tends to surge as investors flock to secure their core assets through metal acquisition.

Beyond its role in buy-and-sell transactions, gold serves as a hedge, offering a strategic addition to investment portfolios to mitigate risks and stabilize returns. Notably, the speculative dimension of gold is a significant driver of its value increase. Analysts often attribute this to the metal’s rarity, which, coupled with the substantial costs associated with mining and processing, ensures a relatively stable demand from industry and jewelry sectors.

However, the speculative use of gold brings along certain downsides. Firstly, it can contribute to inflation since the increase in the value of gold subsequently affects the prices of other goods and services. Secondly, there’s the potential for an economic imbalance as the increased value may incentivize heightened extraction and production, resulting in elevated greenhouse gas emissions and environmental pollution.

Several alternatives have been proposed to address the problems associated with the speculative use of gold. One of them is utilizing gold as an investment asset, allowing it to stabilize its value and mitigate inflation. It’s crucial to recognize that treating gold as an investment involves managing and aligning one’s portfolio with prevailing market conditions and global trends.

Another alternative involves promoting the use of gold in the production of goods and services. By doing so, the cost of gold can be reduced, and speculative demand may be tempered. Gold can also be harnessed for technological innovation, further increasing its value and stimulating economic growth. For example, one of the methods may be tax control. Tax control represents one avenue, as legislation in many countries may impose restrictions and taxes on gold transactions to influence its usage.

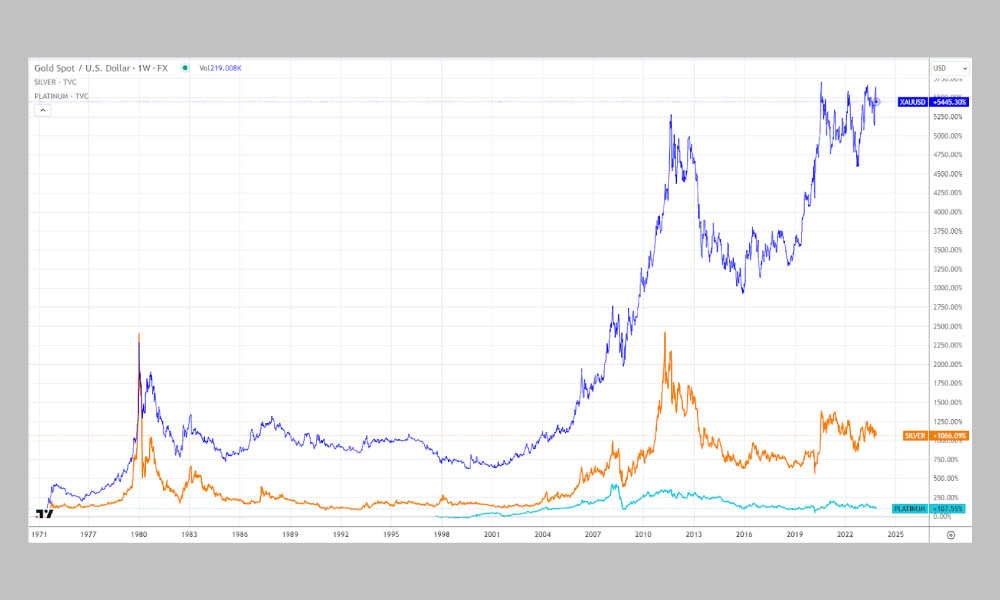

Despite its popularity and volatility compared to base metals like silver and platinum (as shown in the chart above), the speculative use of gold presents a multifaceted problem requiring a holistic approach. Combining measures to stabilize its value, reduce inflation, and encourage its productive application is essential. Gold exchange trading remains one of the most stable and reliable investment avenue, yet, like any asset, it comes with risks that demand careful research, strategy planning, and diversification for investors to maximize their chances of success.